Buying your first home is exciting, but it comes with a range of responsibilities. This guide to the things every first time homebuyer should do is designed to help you avoid common mistakes, focus on essential steps, and ensure you feel confident throughout the homebuying process. You’ll learn how to protect your investment with smart planning and proactive decision-making.

Start with Financial Readiness

Before attending any open house events, review your finances and get pre-approved for a mortgage. Understand your budget so you know your true purchasing power. Calculating estimated costs for the purchase and property taxes, homeowners’ insurance, and maintenance will prevent surprises down the road.

Thoroughly Inspect the Property

A home inspection is a must when considering any property. Always be present during the inspection. Ask questions and request clarification on areas that seem unclear or concerning. Rely on professional inspectors to bring issues to your attention, and don’t skip any recommended follow-up evaluations. This will help you make an informed decision before you own the home.

Standard inspections sometimes miss issues hidden inside drains or sewer lines. For peace of mind, consider a camera inspection. This service reveals internal pipe problems that could lead to costly repairs in the future. A specialized camera inspection gives you a view inside the plumbing, alerting you to cracks, blockages, or root invasions that may not show up during general inspections. This information gives you a valuable advantage in negotiations and helps you plan repairs if needed.

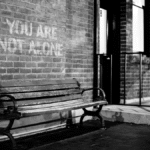

Research the Neighborhood

Location is just as important as the house itself. Explore the neighborhood at different times of the day and week. Pay attention to local amenities, traffic, and noise levels. Ask potential neighbors about their experiences. Review the crime rate and look into the quality of local schools. This helps you avoid regretting your choice after moving in.

Make a Smart Offer

Once you are satisfied with your research and inspections, work with your agent to prepare a realistic offer. Analyze comparable sales in the area and stay disciplined if a bidding war erupts. Communicate any requests or contingencies clearly with the seller. Review the contract thoroughly with legal or real estate support to ensure every detail serves your best interest.

Protect Your Investment for the Long-Term

The things every first time homebuyer should do go beyond signing papers and getting your keys. Stay proactive about home maintenance, address repairs quickly, and record all work done. Building relationships with local service providers ensures you have reliable help when you need it.

With careful planning, you increase the chance of loving your new home for many years. Taking these precautions turns your dream of homeownership into a solid, long-term success.

Deering Estate

Deering Estate

Massage Envy South Miami

Massage Envy South Miami

Calla Blow Dry

Calla Blow Dry

My Derma Clinic

My Derma Clinic

Sushi Maki

Sushi Maki

Sports Grill

Sports Grill

The Healthy Kitchen

The Healthy Kitchen

Golden Rule Seafood

Golden Rule Seafood

Malanga Cuban Café

Malanga Cuban Café

Kathleen Ballard

Kathleen Ballard

Panter, Panter & Sampedro

Panter, Panter & Sampedro

Vintage Liquors

Vintage Liquors

The Dog from Ipanema

The Dog from Ipanema

Rubinstein Family Chiropractic

Rubinstein Family Chiropractic

Your Pet’s Best

Your Pet’s Best

Indigo Republic

Indigo Republic

ATR Luxury Homes

ATR Luxury Homes

2112 Design Studio

2112 Design Studio

Hamilton Fox & Company

Hamilton Fox & Company

Creative Design Services

Creative Design Services

Best Pest Professionals

Best Pest Professionals

HD Tree Services

HD Tree Services

Trinity Air Conditioning Company

Trinity Air Conditioning Company

Cisca Construction & Development

Cisca Construction & Development

Mosquito Joe

Mosquito Joe

Cutler Bay Solar Solutions

Cutler Bay Solar Solutions

Miami Royal Ballet & Dance

Miami Royal Ballet & Dance

Christopher Columbus

Christopher Columbus

Pineview Preschools

Pineview Preschools

Westminster

Westminster

Carrollton

Carrollton

Lil’ Jungle

Lil’ Jungle

Frost Science Museum

Frost Science Museum

Palmer Trinity School

Palmer Trinity School

South Florida Music

South Florida Music

Pinecrest Orthodontics

Pinecrest Orthodontics

Dr. Bob Pediatric Dentist

Dr. Bob Pediatric Dentist

d.pediatrics

d.pediatrics

South Miami Women’s Health

South Miami Women’s Health

The Spot Barbershop

The Spot Barbershop

My Derma Clinic

My Derma Clinic

Miami Dance Project

Miami Dance Project

Rubinstein Family Chiropractic

Rubinstein Family Chiropractic

Indigo Republic

Indigo Republic

Safes Universe

Safes Universe

Vintage Liquors

Vintage Liquors

Evenings Delight

Evenings Delight

Atchana’s Homegrown Thai

Atchana’s Homegrown Thai

Baptist Health South Florida

Baptist Health South Florida

Laser Eye Center of Miami

Laser Eye Center of Miami

Visiting Angels

Visiting Angels

OpusCare of South Florida

OpusCare of South Florida

Your Pet’s Best

Your Pet’s Best

HD Tree Services

HD Tree Services

Hamilton Fox & Company

Hamilton Fox & Company

Creative Design Services

Creative Design Services