We are amid a perfect storm, with high demand for single family homes, low supply of inventory, appreciation in prices and low interest rates that have all converged toward a V-shaped recovery in the housing market. There is a crisis of inventory across the country and a need for more product to satisfy the buyer demand. It is a great time to be a seller, especially in our market.

Suburban areas outperform urban areas during this recovery. Properties in the suburbs are selling faster and at higher prices than those in the urban areas. Condo dwellers and transplants from other states seek out the tax climate with bigger and greener spaces.

There is one challenge. Since the beginning of the pandemic in March, nearly 400,000 fewer homes have been listed compared to last year, leaving a gaping hole in the US housing inventory. As a result, home prices are accelerating at double last year’s pace, per realtor.com. Homeowners are sitting on a boat load of tax-free equity.

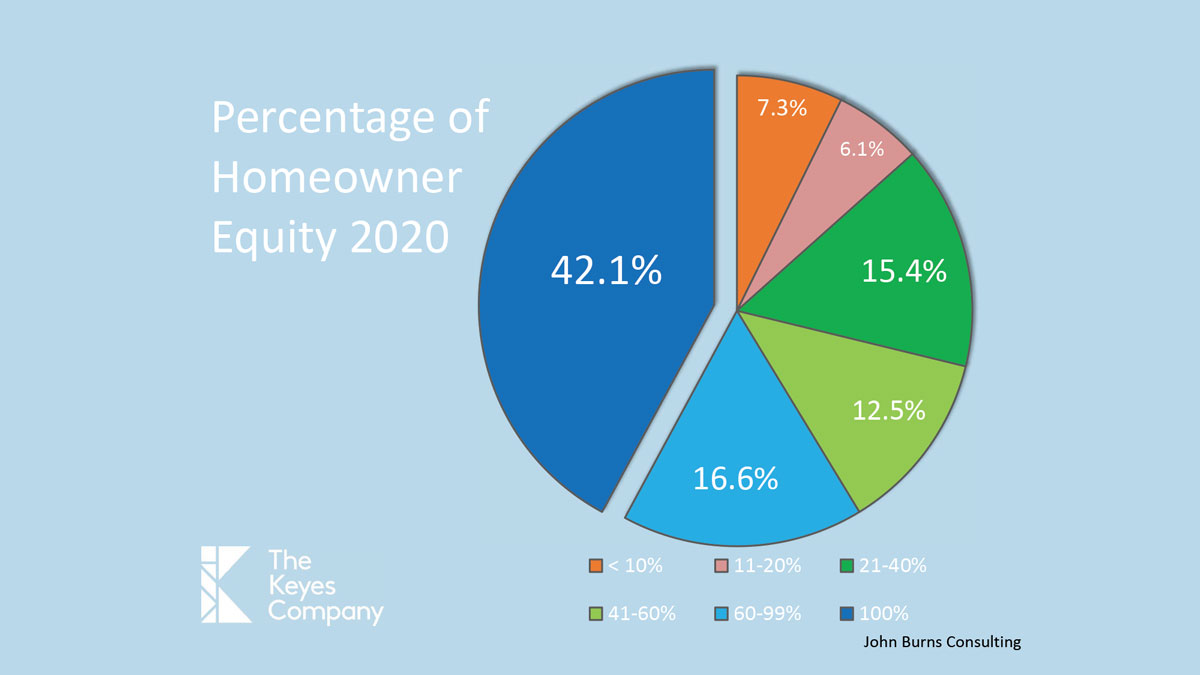

As equity in the homes increase, homeowners are more likely to consider using that equity to purchase a home that suits them better. It could be a step-up to a larger home, to a different location, or a second home. On average through Q2 of 2020, Florida homeowners have enjoyed a $10,000 equity gain on their home year-over-year.

Urban areas are also enjoying a faster pace in sales than last year with slightly higher appreciation as well. On the condominium front in Miami, there is an oversupply of inventory and prices are depreciating. However, long-term the inventory will be consumed given the migration patterns that are bringing us new Floridians every day.

Commercial real estate in South Florida also benefits from the migratory pattern in the industrial segment with demand for order fulfillment centers. Consumer confidence is coming back with restaurants opening again. Our son Michael is now sous chef at L ’Atelier de Joel Robuchon in downtown Miami. Welcome back fine dining!

Can we keep this up? Consumer spending is recovering and a key driver for the overall economy.

The fear with salary reductions, pandemic, sickness, and overall uncertainty disrupted peace of mind. However, people started managing the risks and with a collective breath, continue the recovery. From rushing for toilet paper and depleted foodstuffs, to gratitude for infinite blessings and deepest condolences for our neighbors lost to the pandemic, we still have miles to go for a semblance of peace of mind.

Unemployment in Florida is going down. Job creation and employees that were previously furloughed are coming back. RCL has started cruising in Europe and Asia, a good sign for Carnival, Norwegian and RCL with large presence in Miami. The economy prior to Covid was extremely strong and is recovering faster than during the great depression, the great recession, and the 1980s oil recession.

Forbearance on mortgages are decreasing with approximately 96% of mortgages being on time. We do not anticipate a wave of foreclosures because most homeowners have equity in the home. Over the last 10 years, we have seen appreciation in properties. Lending standards have been solid over the last decade and most of these homeowners have equity in their homes and will likely be able to restructure their loans once they are employed.

The equity built up in homes provides opportunity. Enjoy the sellers’ market to make your move.

Deering Estate

Deering Estate

Massage Envy South Miami

Massage Envy South Miami

Calla Blow Dry

Calla Blow Dry

My Derma Clinic

My Derma Clinic

Sushi Maki

Sushi Maki

Sports Grill

Sports Grill

The Healthy Kitchen

The Healthy Kitchen

Golden Rule Seafood

Golden Rule Seafood

Malanga Cuban Café

Malanga Cuban Café

Kathleen Ballard

Kathleen Ballard

Panter, Panter & Sampedro

Panter, Panter & Sampedro

Vintage Liquors

Vintage Liquors

The Dog from Ipanema

The Dog from Ipanema

Rubinstein Family Chiropractic

Rubinstein Family Chiropractic

Your Pet’s Best

Your Pet’s Best

Indigo Republic

Indigo Republic

ATR Luxury Homes

ATR Luxury Homes

2112 Design Studio

2112 Design Studio

Hamilton Fox & Company

Hamilton Fox & Company

Creative Design Services

Creative Design Services

Best Pest Professionals

Best Pest Professionals

HD Tree Services

HD Tree Services

Trinity Air Conditioning Company

Trinity Air Conditioning Company

Cisca Construction & Development

Cisca Construction & Development

Mosquito Joe

Mosquito Joe

Cutler Bay Solar Solutions

Cutler Bay Solar Solutions

Miami Royal Ballet & Dance

Miami Royal Ballet & Dance

Christopher Columbus

Christopher Columbus

Pineview Preschools

Pineview Preschools

Westminster

Westminster

Carrollton

Carrollton

Lil’ Jungle

Lil’ Jungle

Frost Science Museum

Frost Science Museum

Palmer Trinity School

Palmer Trinity School

South Florida Music

South Florida Music

Pinecrest Orthodontics

Pinecrest Orthodontics

Dr. Bob Pediatric Dentist

Dr. Bob Pediatric Dentist

d.pediatrics

d.pediatrics

South Miami Women’s Health

South Miami Women’s Health

The Spot Barbershop

The Spot Barbershop

My Derma Clinic

My Derma Clinic

Miami Dance Project

Miami Dance Project

Rubinstein Family Chiropractic

Rubinstein Family Chiropractic

Indigo Republic

Indigo Republic

Safes Universe

Safes Universe

Vintage Liquors

Vintage Liquors

Evenings Delight

Evenings Delight

Atchana’s Homegrown Thai

Atchana’s Homegrown Thai

Baptist Health South Florida

Baptist Health South Florida

Laser Eye Center of Miami

Laser Eye Center of Miami

Visiting Angels

Visiting Angels

OpusCare of South Florida

OpusCare of South Florida

Your Pet’s Best

Your Pet’s Best

HD Tree Services

HD Tree Services

Hamilton Fox & Company

Hamilton Fox & Company

Creative Design Services

Creative Design Services